If you just received a car, truck, SUV, or motorcycle as a gift in Pennsylvania, you must transfer the title and get a new tag in order to establish ownership. You can even transfer a license plate you already have onto your gifted vehicle. Once you transfer ownership, you’re just a hop, skip and jump away from riding down those PA streets. In DMV (services) talk, you need a title transfer first, then a registration which includes a registration card and license plate.

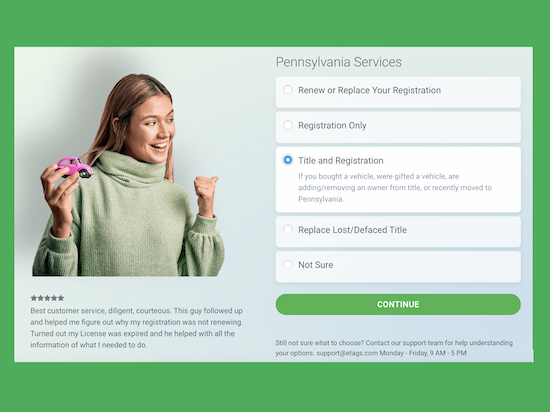

Use eTags© to Quickly Complete Your DMV Service. Renewals, Title Transfers and More, All Online!

Use eTags© to Quickly Complete Your DMV Service. Renewals, Title Transfers and More, All Online!

Transferring ownership of your gifted vehicle is like a private sale transfer

Re-titling your gifted car in the Independence State is a similar process as if you bought it through a private sale, except with some perks. Getting a vehicle as a gift puts you at a unique advantage in that you’re exempt from paying sales tax. In Pennsylvania, depending on where you live, you’d typically pay anywhere from 6% to 8% of the total price paid for the car (in sales tax).

The state of Pennsylvania requires a few documents that you can only get either at DMV in person or by a licensed agent. In order to transfer the title, you’ll fill out the MV-1, or application for transfer of title. And since you received the shiny new gift, you’ll also fill out the MV 13 ST. The sole purpose of this form is to exempt you from paying that sales tax we talked about. make sure you sort out whether you’ll need a new license plate or you plan to transfer one that you already have.

The form MV-1 can only be administered by a DMV authorized agent, the form cannot be downloaded

Put “gift” by the purchase price

Arguably, the most important part of this transaction is making sure your title is filled out correctly. The transferor should put “gift” next to the section called “purchase price” on the title. This will ensure you don’t get stuck with any sort of bill related to Pennsylvania sales tax.

As a rule, the back of the title is reserved for the seller or transferor and the front is for the buyer or transferee. Pro-tip: If the title shows a recorded lien, you need to ask your gifter to get a letter from their lienholder stating that the lien has been satisfied or in other words, paid off. Check for this before you start to transfer your title to avoid any delay!

New Hampshire, Delaware, Montana, Oregon, Alaska, and Washington, DC, doesn’t charge sales tax on cars

Let eTags clear up the misconceptions of car gifts

You may have heard in the past, “gifts are not allowed” in regard to vehicle transfer or sale. Well, this may be true in some places, but it’s certainly not true in Pennsylvania. In fact, the very opposite is the case.

A lot of times, folks will say they sold the vehicle for a dollar to avoid the sales tax. This sets off red flags with PennDOT. The way they see it, the fair market value for vehicles, even over 15 years old is at least $500. “Selling it” for a dollar could put you at risk for an audit letter meaning, you’ve got some explaining to do. It’s possible you could receive a bill for what the actual tax value is.

A few legal matters to tie up before getting on the road

Before you can drive around downtown Scranton in your new ride, you need to make it legal first! Make sure you have a few things:

- The title-signed and notarized by the transferor on the back sections and you, the transferee on the front section. TIP- the title can be a bit confusing with all of its signatures and such. If you aren’t 100% clear on how to complete it, wait until you’re in front of the Notary or a DMV agent. In PA, one wrong signature will “invalidate” the vehicle title and you’ll end up waiting weeks for a replacement.

- Pennsylvania auto insurance– get your insurance before going down to DMV. They’ll ask you for proof in order to register.

- Your driver’s license – well, if you want to drive the car that is!

In Pennsylvania, a wrong or misplaced signature on the title invalidates/voids it

Once you have all your documents in order the next step is to head down to the DMV and complete the transfer of title. While long lines and a packed house are part of the DMV experience or you might want to do some extra research and to look into making an appointment. The walk-in option is being limited at DMVs across the country so get online and find out what the standard is in your county to avoid an unnecessary trip.

License plates are non-transferrable

Please keep in mind license plates are not transferable between people under most circumstances in Pennsylvania. For example, If your neighbor is gifting you a vehicle, they will need to take their license plate off the vehicle and properly turn it into DMV if they no longer plan to use it.

Odds and ends on changing ownership of vehicle

When you need to change ownership and register a car in PA, you’ve got 20 days in PA to do so. Keep in mind that a vehicle safety inspection and depending on your county, even emissions checks might be required. Motorcycles and classic/antique vehicles (or any vehicles older than 1975 for that matter) are exempt from the emissions inspection.

Vehicles older than 1975 don’t require emissions testing in the Independence State

eTags is an easier option

If you want to avoid the hassle altogether, go for a company like eTags. You can safely and securely transfer your title and register your Pennsylvania vehicle online. The online tag and title company follows all the same rules and regulations as DMV. So this means you’ll still need to obtain the proper notaries but the folks at eTags can walk you through the process. eTags even uses tracked shipping for safe transport of your important paperwork.