The Unified Carried Registration program (UCR) is a state program, but it’s established under federal law. It involves interstate commerce where interstate commercial motor vehicle owners pay annual fees for their UCR registration using their DOT number.

Use eTags© to Quickly Complete Your DMV Service. Renewals, Title Transfers and More, All Online!

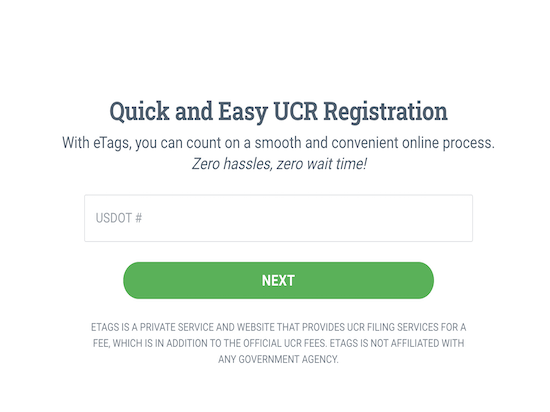

To easily apply for your UCR registration 2020, go to eTags UCR registration online, and follow the prompts. All we need is your US DOT number. You’ll have multiple payment options, renewal reminders in the future and customer support should you need it.

Who is subject to UCR registration 2020? The following categories provide they operate interstate commerce in the U.S.

• Motor carriers of property, both for hire and private

• For-hire passenger motor carriers

• Freight forwarders

• Brokers

• Leasing companies that lease vehicles, without drivers, to interstate motor carriers and freight forwarders

UCR participating states and non-participating states

41 states participate in this program, excluding Oregon, Nevada, Arizona, Florida, Maryland, Vermont, New Jersey, Wyoming, the District of Columbia and Hawaii. However, any commercial motor vehicle owner that travels ONLY within their base state, BUT carries goods from a participating state, would still have to pay UCR registration fees.

How do you choose your base state for UCR registration 2020

According to the Federal Motor Carrier Safety Administration, if your principal place of business is in a state that participates in the UCR program, that state is the entity’s UCR base state.

If you don’t have a principal place of business in a participating state, but have a place of business – an office or operating facility – in a participating state, then you must select that state as your UCR base. If you have such a place of business in more than one participating state, you can choose any one of them as your base state.

Select UCR Base State Following UCR Guidance

If you don’t have a place of business in any state that participates in UCR, you must choose your base according to the UCR Board’s guidance:

If the registrant doesn’t have a place of business in any participating state, it may choose as its base the participating state that is closest to its principal place of business.

*If the registrant’s principal place of business is in Maryland, New Jersey, Vermont, the District of Columbia, or any of the six eastern Canadian provinces, it may select Connecticut, Delaware, Maine, Massachusetts, New Hampshire, New York, Pennsylvania, Rhode Island, Virginia, or West Virginia as its base state.

*If the registrant’s principal place of business is in Florida or Mexico, it may select Alabama, Arkansas, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, or Texas as its base state.

If the registrant’s principal place of business is in Manitoba, Ontario, or the Canadian territory of Nunavut, it may select Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, Ohio, or Wisconsin as its base state.

If the registrant’s principal place of business is in Arizona, Hawaii, Nevada, Oregon, Wyoming, the four western Canadian provinces, the Canadian Northwest Territories or Yukon Territory, or Mexico, it may select Alaska, California, Colorado, Idaho, Montana, New Mexico, North Dakota, South Dakota, Utah, or Washington as its base state.

*Please note that registrants in Ontario, Manitoba, or Mexico may under these rules choose their base state from among more than one of the * (starred) groups.

2 comments

We have been doing our UCR with the wrong base state. What is the procedure to change to the right one?

We apologize, but we no longer offer UCR services.